28 February 2023

.png/92bcf8f60631d21a0b9970c020b5408c)

Weekly Outlook - PMIs in Focus after Weaker Flash Manufacturing

Technical Analysis

Headlines last week were focused on the anniversary of the start of the war in Ukraine, with data affirming the narrative that interest rates could go higher. Attention now turns to confirming preliminary PMIs, which saw continuing industrial weakness but resilient services.

3 Top Events for the Week Ahead

Global final February PMIs expected to support room for more hikes

Eurozone flash February CPI on Thursday

US PMI figures expected to improve on Wednesday and Friday

PMIs Expected to Support Better Services Sector

Investors are keen to see what the latest PMIs from China show, as it's the first month since reopening that didn't include a major holiday. European PMIs are expected to confirm the flash numbers showing a weaker industrial sector but services improving. US ISM PMI is also in focus after preliminary Markit PMIs came in above expectations.

China's A50 index peaked at 14413 but started to pull back after seeing momentum exhaustion. If the PMI figures come in better than expected, the local support by the 38.2% Fibonacci could be the bottom. However, failing to reenter the upward channel could reveal weakness going forward, which makes the 14k handle recapturing crucial for price action. In the event PMIs disappoint, the index could slide towards the golden pocket of 12378, with a likely interruption by the 50% Fibonacci at 12772.

Tradingview Chart: China A50

Eurozone Flash CPI Figures to Show Increase

After confirming that inflation in the shared economy hit the highest level on record in January, the first look at February CPI figures is expected to show a slight pullback in the annual rate. But it's also expected that monthly CPI will advance, which could provide more impetus for the ECB to hike more aggressively when it meets later in March. Annual core CPI is expected to come down by just a decimal.

EUR/JPY bulls attempted to accelerate the trend by pushing prices past the upper channel, but momentum disappointed, and the pair failed to get through the golden ratio with conviction. Higher than anticipated inflation could mark a breakout towards the round 146.00 hurdle, dependent on the spread between the actual and 8.2%. On the flip side, 142.92 is major support, and a swing low bulls must defend to keep a bearish reaction, which is supported by divergence, at bay.

Tradingview Chart: Euro / Japanese Yen

US ISM PMIs to Add to Hiking Narrative

After a series of data pointing to a resilient consumer but flagging industrial sector, ISM Manufacturing PMI is expected to move up to 48.0 from 47.4 in January. While still in contraction, the improvement could be seen as another data point suggesting the economy remains resilient in spite of higher rate hikes, which could support further expectations of a 50 bps hike at the next meeting. ISM Non-Manufacturing PMI is expected to fall slightly but remain solidly in expansion at 54.6 compared to 55.2 in January.

Of the major pairs, the kiwi appears to diverge quite a bit with momentum as it forms support by the 38.2% Fibonacci around 0.6140. In fact, it reveals two consecutive bullish divergence signals, making it a good candidate against a data backdrop. In such a scenario, NZD/USD could advance towards 63 cents if bulls manage to reclaim $0.6227. But if the US PMIs come in better than expected, the pair could succumb towards the 60-cent threshold, diminishing chances of momentum reversal.

Tradingview Chart: New Zealand Dollar / U.S. Dollar

3 Top Events in Review

BOJ governor nominee Kazuo Ueda gave his much-awaited testimony in the upper house of Japan's parliament, largely affirming support for the existing policy, which led to fluctuations in the yen, though it stabilised quickly.

FOMC minutes came out with little surprises, showing officials discussing a 50 bps hike and attention now turning to the tightness in the labour sector. Dollar continued to strengthen on growing bets of a larger hike at the next Fed meeting.

Eurozone CPI was revised upward, hitting a record high.

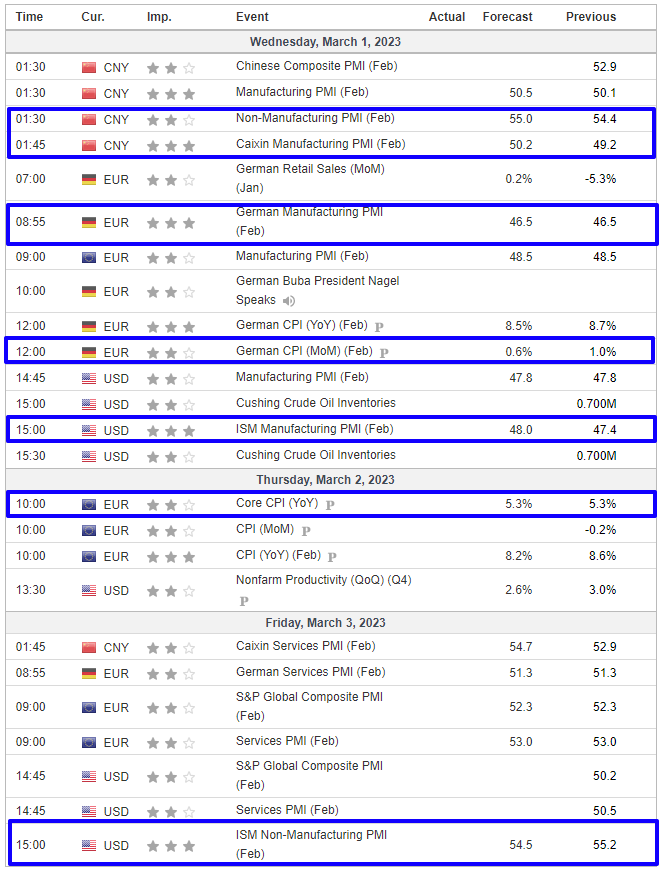

Major Calendar Events Feb 28 - Mar 3 (GMT)

Source: Investing.com

Disclaimer: Any information presented is for general education and informational purposes hence, not intended to be and does not constitute investment or trading advice or recommendation. No opinion given in the material constitutes a recommendation by M4Markets that any particular investment, security, transaction or investment strategy is suitable for any specific person.

It does not take into account your personal circumstances or objectives. Any information relating to past performance of an investment does not necessarily guarantee future performance.

Trinota Markets (Global) Limited does not give warranty as to the accuracy and completeness of this information.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider.

Latest News

31 March 2025

Update Trading Schedule | April 4th - May 2nd

31 March 2025

Update Trading Schedule | April 4th - May 2nd

1

1

Register & Verify your Profile

2

2

Open a Live Account & Fund It

3

3

English

English

简体中文

简体中文

Bahasa Indonesia

Bahasa Indonesia

Bahasa Melayu

Bahasa Melayu

Tiếng Việt

Tiếng Việt

ไทย

ไทย

Español

Español

Português

Português

日本語

日本語

Arabic

Arabic

한국어

한국어